6 Reasons to Be Skeptical of Debt-Phobia

In the lead-up to tomorrow’s pre-election Commonwealth budget, much has been written about the need to quickly eliminate the government’s deficit, and reduce its accumulated debt. The standard shibboleths are being liberally invoked: government must face hard truths and learn to live within its means; government must balance its budget (just like households do); debt-raters will punish us for our profligacy; and more. Pumping up fear of government debt is always an essential step in preparing the public to accept cutbacks in essential public services. And with Australians heading to the polls, the tough-love imagery serves another function: instilling fear that a change in government, at such a fragile time, would threaten the “stability” of Australia’s economy.

However, this well-worn line of rhetoric will fit uncomfortably for the Coalition government, given its indecisive and contradictory approach to fiscal policy while in office. The deficit has gotten bigger, not smaller, on their watch, despite the destructive and unnecessary cutbacks in public services imposed in their first budget. Their response to Australia’s fiscal and economic problems has consisted mostly of floating one half-formed trial balloon after another (from raising the GST to transferring income tax powers to the states to cutting corporate taxes), with no systematic analysis or framework. And their ideological desire to invoke a phony debt “crisis” as an excuse for ratcheting down spending will conflict with another, more immediate priority: throwing around new money (or at least announcements of new money), especially in marginal electorates, in hopes of buying their way back into office.

In short, the politics of debt and deficits will be both intense and complicated in the coming weeks. To help inoculate Australians against this hysteria, here are six important facts about public debt, what it is – and what it isn’t.

1. Australia’s public debt is relatively small

Despite annual deficits incurred since the GFC, Australia’s accumulated government debt is still small by international standards. Debt can be measured on a gross or net basis; gross debt counts total outstanding borrowing, while net debt deducts the value of financial assets which the government also possesses. Gross debt for all levels of government equaled 44% of Australian GDP at the end of 2015 (according to the OECD). That was the 5th lowest indebtedness of any of the 34 OECD countries (see table below), equal to about one-third the average level experienced across the OECD. Moreover, despite recent deficits, the growth of debt in Australia was considerably slower than in most other OECD countries. Of course, having low debt in and of itself does not justify increasing it. But given the universal fiscal challenges that have faced industrial countries since the GFC, Australia’s debt challenge is both unsurprising and relatively mild.

| Australia’s Debt in International Context: General Government (all levels) Gross Financial Liabilities (%GDP) | ||

| 2015 | 10-yr. Change | |

| Australia | 44.2% | +22.4 pts |

| U.S. | 110.6% | +43.7 pts |

| Japan | 229.2% | +59.7 pts |

| France | 120.1% | +38.3 pts |

| Germany | 78.5% | +8.1 pts |

| Italy | 160.7% | +41.8 pts |

| U.K. | 116.4% | +60.3 pts |

| Canada | 94.8% | +19.0 pts |

| OECD Average | 115.2% | +36.3 pts |

| Source: Author’s calculations from OECD Economic Outlook #98, Nov.2015. | ||

2. A government debt is matched by an asset

Australians aren’t “poorer” because their government accumulates a debt. Any rise in government debt is mirrored by an increase in some offsetting asset. This is true in both accounting terms, and in real economic terms. For example, government typically issues a bond (or some other financial instrument) to finance a deficit. But that bond also constitutes an asset in the investment portfolio of whoever lent the government money. Most Australian government debt is owned by Australians. In fact, investors increasingly appreciate the opportunity to invest in government bonds, because they are safer than other assets at a time of financial uncertainty. (That investor interest is one reason interest rates on government debt are so low.) So government debt translates into someone else’s wealth – usually someone in Australia.

This match between liabilities and assets is also visible in concrete economic terms – especially when new debt is issued to construct a real, long-lasting capital asset (like a road, a transit system, a school, or a hospital). In this case, the matching asset is owned by government itself, and so its own net worth won’t change much at all: it takes on a new debt, but also has a new asset. For budgetary purposes, the government must account for the gradual wear-and-tear of that asset (called depreciation), which appears as a cost item on the budget. But it hasn’t “lost” the money it raised through the new debt: it invested it, and that investment carries both financial and social value.

3. Other sectors of society borrow much more than government

Tired rhetoric about how governments need to act “more like households” is especially ironic, given that households are by far the most indebted sector in Australian society. Household net debts equal close to 125% of GDP – or around 4 times the net debt of government (all levels), according to data from the Bank for International Settlements. It is factually wrong to claim that “households balance their budgets,” and therefore governments must do the same. Households borrow regularly – and thanks to overinflated housing prices and stagnant wages, that borrowing is growing rapidly. The same is true of business: net debts of non-financial corporations are more than twice the net debt of government (see chart).

In fact, it is quite rational for households and businesses to borrow, when needed to fund purchase of long-run productive assets (like a house or a car for consumers, or a factory or new technology for a business). Business leaders know that rational, prudent borrowing will enhance the profitability of a corporation. Indeed, any CEO who said paying off all company debt was the top priority of the firm would be chased from office by directors and shareholders (who would understand the pledge was irrational and superstitious). Following exactly the same logic, government debt can be rational and productive – especially (but not only) when it is associated with the acquisition of long-run productive assets (like infrastructure). Close to two-thirds of the Commonwealth government’s 2015/16 deficit (projected to be $36 billion) is associated with capital spending, including $11 billion in capital transfers to lower levels of government and $12 billion in net investment in Commonwealth non-financial assets. Contrary to the rhetoric, Australians do largely cover the cost of current public services with their current tax payments. Government borrowing is primarily required to fund capital spending.

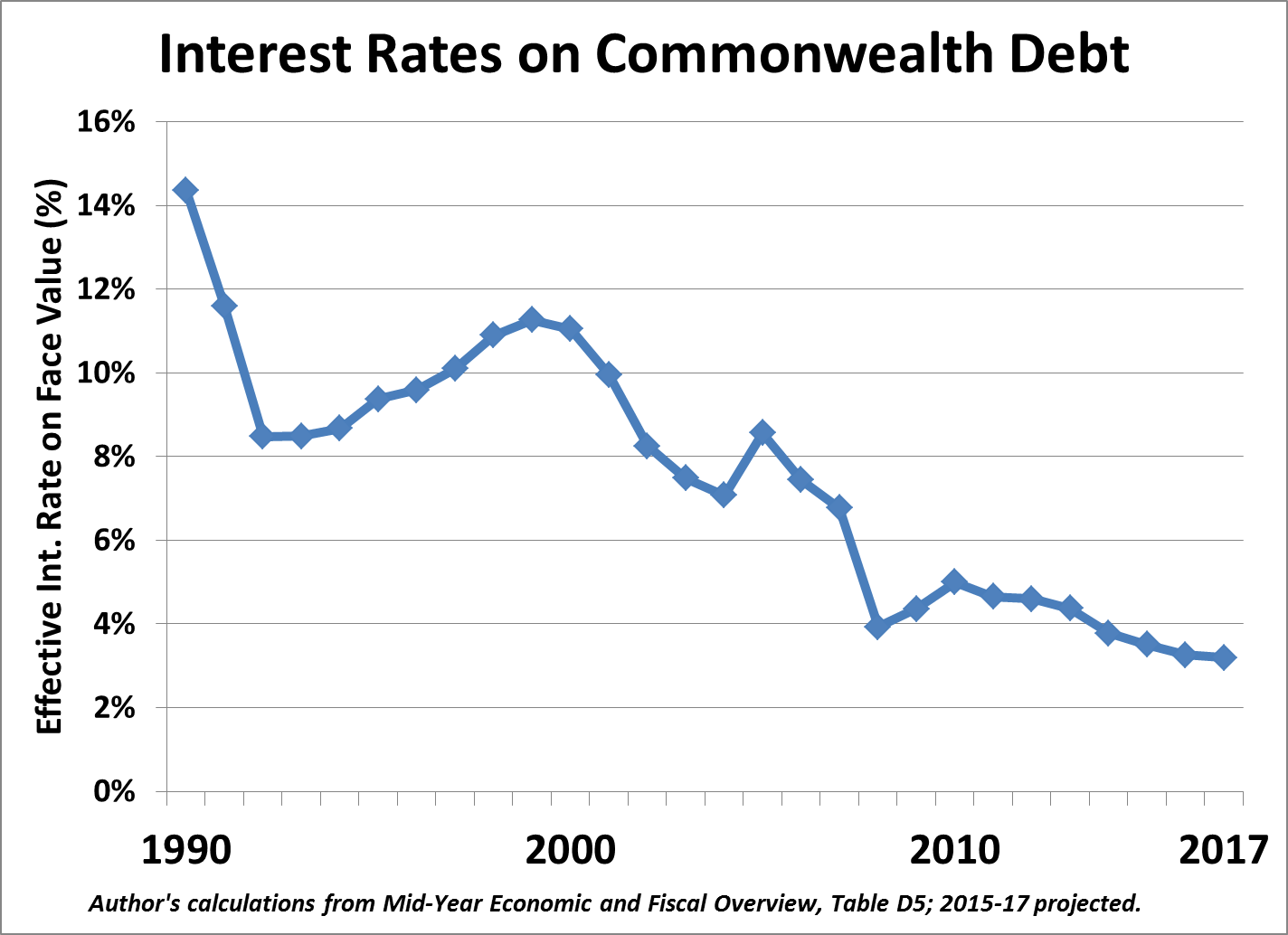

4. Interest rates are low, and falling

The cost of public borrowing has fallen dramatically as a result of the decline in Australian and global interest rates since the GFC (see chart). Indeed, the two factors are connected: large government deficits resulted primarily from underlying economic weakness (this is true in Australia, like elsewhere in the industrialized world), which in turn bro8ught about low interest rates (via both central banks and private financial markets). These very low interest rates mean that the cost-benefit decision associated with any new government borrowing has been fundamentally altered, in favour of borrowing.

Current interest rates are likely to stay low for many years to come, given the continuing failure of the global economy to regain consistent momentum, the slowdown in China, and other factors. (In fact, it is possible that the Reserve Bank of Australia may soon cut its interest rate further, below its current record-low 2% level, due to weak growth and signs of deflation here in Australia.) Ten-year Commonwealth bonds can presently be floated to private investors for little more than 2% interest (close to zero in real after-inflation terms). If government can borrow for what is effectively zero interest, and put that money to work in the real economy doing useful things (including both infrastructure and public services), then it is irrational to let old-fashioned balanced-budget mythology stand in the way.

Even if current interest rates do not fall any further, the average effective interest rate paid on overall public debt will continue to fall for years to come. The current average effective rate paid on Commonwealth debt (about 3.5% last year) reflects the weighted average paid on all maturities of debt. As past debts come due, they are refinanced at now-much-lower interest rates (those prevailing on new issues of bonds). That will pull down the average weighted interest rate for several years into the future – even if the rate on new issues stabilizes or increases somewhat. Consider that new ten-year bonds can be issued for less than half the interest rate paid a decade ago. The refinancing of those bonds will generate enormous future interest savings for government (equivalent to home-owners who re-mortgage their homes to benefit from the decline in household lending rates).

This is why the economic burden of public debt servicing is not growing, even though the debt is. Government budget projections forecast debt service remaining at between 0.9 and 1.0% of GDP for the next 5 years, with the effect of rising debt offset by falling interest rates. And those government projections likely overestimate true interest costs (partly for political reasons). For example, the December 2015 MYEFO update assumes a significant increase in interest rates in the coming year (its near-term interest rate assumption was 0.3 points higher than the assumption used in last year’s budget); ongoing global and domestic economic weakness makes that highly unlikely.

5. The debt/GDP ratio is a more meaningful fiscal constraint than a balanced budget

Fear-mongers think that by talking about public debt in “big numbers,” the fright value of their dire forecasts can be magnified accordingly. But all macroeconomic aggregates are measured in big numbers. And what’s more important than the absolute size of debt, is the government’s capacity to service that debt. That, in turn, depends on the flow of government revenues, which in turn is driven primarily by overall economic growth. That’s why economists prefer to evaluate public debt relative to GDP (called the “debt ratio”). Even this ratio can overstate the real burden of debt, in times (like now) when interest rates are low and falling.

Avoiding a lasting, uncontrolled rise in the debt/GDP ratio is a more meaningful fiscal constraint on government, than trying to balance a budget in any particular year. Economists do not agree on a maximum “acceptable” limit for that ratio. But most agree it cannot rise forever. (Some economists argue that there is no limit on a government’s ability to issue sovereign debt denominated in its own currency, and the recent experience of countries like Japan – whose debt ratio is five times Australia’s – is consistent with that view.)

At any rate, Australia is far away from any feasible “ceiling” on public debt relative to GDP. And remember, like any ratio, the debt/GDP ratio has both a numerator and denominator: growing the denominator is as effective as shrinking the numerator, if the goal is reducing the value of the combined ratio. In this regard, the stagnation in Australia’s nominal GDP in recent years has been more damaging to the trajectory of the debt ratio, as has the addition of debt through continued deficits. The government’s policy focus should be on expanding economic activity (and the jobs and incomes that go with it), rather than suppressing the deficit with austerity measures (which have the unintended consequence of undermining growth and hence the economy’s ability to service a given amount of debt).

6. The government can incur moderate deficits every year, yet still stabilize its debt burden

A related and under-appreciated countervailing argument is to note that government can run a medium-sized deficit on an ongoing basis, and yet experience no increase in the debt/GDP ratio at all – so long as the economy is progressing at a normal pace. A deficit adds to the numerator of the ratio, while economic growth expands the denominator. So long as both are expanding at roughly the same rate, the ratio will not be changed. (Our reference to economic expansion envisions more jobs and incomes across the economy, including in the public sector, and with due attention to the need for environmental sustainability.) This basic arithmetic provides government with an additional degree of maneuverability in financing essential services and investments, without unduly increasing the debt ratio.

A simple numerical example helps to illustrate the point in Australia’s context. A healthy economy should be expanding by at least 5-6 percent per year in nominal terms: divided roughly equally between inflation (given the RBA’s 2-3 percent inflation target) and greater output of real goods and services (driven by both population and productivity). The Commonwealth’s current net debt ratio is slightly below 20 percent of GDP. With a healthy economic expansion, the government could incur an annual deficit of 1-1.25 percent of GDP (or close to $20 billion per year) but still stabilize the debt ratio below that 20 percent benchmark. And there is nothing magical about a 20% debt ratio; if Australians were willing to tolerate a larger steady-state debt ratio, then the size of this annual permissible deficit would be correspondingly higher. All this merely reinforces the need for government to focus on supporting job-creation and incomes, not balancing its budget – and confirms that ample fiscal space is indeed available for the Commonwealth to fund public services and infrastructure spending (with the fringe benefit of reinforcing strong job creation that should be their top priority).

You might also like

Australia’s “stupid” surplus obsession must end

A budget surplus doesn’t mean a government is good at running the economy – we should focus on the choices they make instead, says Greg Jericho.

“Right to Disconnect” Essential as Devices Intrude Into Workers’ Lives

Australia’s Parliament is set to pass a new set of reforms to the Fair Work Act and other labour laws, that would enshrine certain protections for workers against being contacted or ordered to perform work outside of normal working hours. This “Right to Disconnect” is an important step in limiting the steady encroachment of work

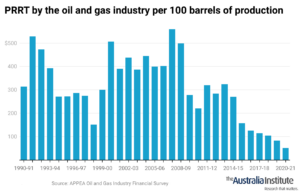

The gas industry is laughing at us as they make more money but not more tax

Despite soaring production and revenues the gas industry is not paying more tax