Opinions

May 2024

Does leave for menstruation and menopause advance women’s rights and gender equality at work?

As pressure grows for action to establish new work rights, including additional leave, for those who experience menstruation and menopause, the Centre for Future Work’s Senior Researcher, Lisa Heap, canvases the debate about whether these rights will advance gender equality at work.

April 2024

Video: The Right to Disconnect is NOT Bad for Productivity

The Right to Disconnect legislation being passed recently has attracted criticism from Opposition leader Peter Dutton and business groups, who say it’s bad for productivity. They may need to learn some basic maths, because they couldn’t be more wrong. Centre for Future Work Director Dr Jim Stanford explains. Research indicates the average Australian worker performs

March 2024

Fixing the work and care crisis means tackling insecure and unpredictable work

The Fair Work Commission is examining how to reduce insecurity and unpredictability in part-time and casual work to help employees better balance work and care. The Commission is reviewing modern awards that set out terms and conditions of employment for many working Australians to consider how workplace relations settings in awards impact on work and

On International Women’s Day: How the Fair Work Commission Can Really Take On the Gender Pay Gap

On occasion of International Women’s Day, the Centre for Future Work’s Senior Researcher Lisa Heap reviews the opportunities to use recent industrial relations reforms to more ambitiously address Australia’s gender pay gap.

February 2024

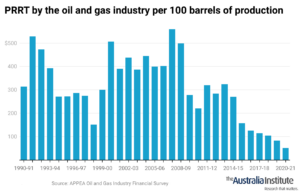

The gas industry is laughing at us as they make more money but not more tax

Despite soaring production and revenues the gas industry is not paying more tax

More loopholes to close on insecure work … and a new right to disconnect from work

Late yesterday the final part 2 of the government’s Closing Loopholes industrial relations bill was passed by the Senate.

“Right to Disconnect” Essential as Devices Intrude Into Workers’ Lives

Australia’s Parliament is set to pass a new set of reforms to the Fair Work Act and other labour laws, that would enshrine certain protections for workers against being contacted or ordered to perform work outside of normal working hours. This “Right to Disconnect” is an important step in limiting the steady encroachment of work

January 2024

We Cannot Truly Value ‘Care’ Until Workers Using Digital Labour Platforms Get Fair Pay and Conditions

Unless minimum employment standards for care and support workers using digital labour platforms are guaranteed, decades of slow progress towards proper recognition of care work and equal pay for women could be undone.

December 2023

Closing Loopholes: Important repairs to the industrial relations system, no more, no less

Labour hire workers can no longer be paid less than employees doing the same job in their workplaces as a result of industrial reforms passed by Parliament. However, other important reforms to close loopholes in employment laws and stop exploitation of workers and avoidance of standards won’t be voted on in Parliament until next year.

The Stage 3 tax cuts will make our bad tax system worse

Australia has one of the weakest tax systems for redistribution among industrial nations, and as Dr Jim Stanford writes, the Stage 3 tax cuts will make it worse.

Higher exports prices improve the budget, but the Stage 3 tax cuts remain the wrong tax at the wrong time

As the Budget outlook improves, with most of the benefits of Stage 3 tax cuts going to those earing over $120,000, over 80% of workers will be short-changed

November 2023

After two years of profit-led inflation, workers deserve the pay rises they are getting

The wage rises for low-paid workers on awards and those working in aged care helped drive the strong wage growth.

The Government needs to act on Stage 3 as the RBA warns about wealthy households spending

The RBA made it clear one group continues to do well, and continue to spend – and they are also the ones who are about to get a massive tax cut.

When the prices of necessities are rising fast, the RBA does not need to hit households with another rate rise

Cost of living rose by more than inflation because of interest rate rises. Another rate rise would only cause more unnecessary pain.

October 2023

The Reserve Bank should not raise rates on Melbourne Cup Day

Inflation is being driven by things unaffected by interest rate, so there is no reason for the RBA to raise rates in November

Australia is an energy super power, we need to use that power for good

Australia is already an energy superpower, but our governments have lacked the courage to use that power to reduce greenhouse gas emissions

The latest report from the IMF highlights the need for full-employment to be the aim of the government and the Reserve Bank

If the economy grows as slowly as the IMF predicts it will for the next 2 years, Australia will be lucky to avoid a recession.

Insecure work is a feature of our labour market. New laws can change that.

Chris Wright is Associate Professor in the Discipline of Work and Organisational Studies at the University of Sydney, and a member of the Centre for Future Work’s Advisory Committee. This commentary is based on his submission to the Senate Education and Employment Legislation Committee’s inquiry into the Fair Work Legislation Amendment (Closing Loopholes) Bill 2023,

September 2023

Inflation remains headed in the right direction despite higher oil prices

Increases in the prices of commodities like oil and gas are not a reason for the RBA to raise interest rates next week

Opening statement to the ACTU Price Gouging Inquiry

This week Professor Allan Fels, the former head of the Australian Competition and Consumer Commission (ACCC), has begun an inquiry into price gouging across a range of industries, including banks, insurance companies, supermarkets, and energy providers. The inquiry commissioned by the ACTU comes off the back of the highest inflation in 30 years and the biggest falls in real wages on record.

Millionaire Tim Gurner’s Refreshing Honesty Reveals the Soul of Business

Every now and then a window opens into the soul of the business community, and we catch a glimpse of the values and goals that shape the actions of the captains of industry.

New laws for ‘employee-like’ gig workers are good but far from perfect

The Workplace Relations Minister Tony Burke has described proposed new laws to regulate digital platform work as building a ramp with employees at the top, independent contractors at the bottom, and gig platform workers halfway up. The new laws will allow the Fair Work Commission to set minimum standards for ‘employee-like workers’ on digital platforms.

The weak economy shows the Reserve Bank is not threading the needle

We have now had two consecutive quarters of GDP per capita falling – hardly the soft landing the RBA wants.

August 2023

Australia’s emissions are rising at a time they need to fall quickly

The latest quarterly greenhouse gas emissions survey shows that Australia is heading in the wrong direction – and that needs calling out.

Urgent Need for Australia’s Climate Industry Policy

For the first time in decades, Australia is talking about industry policy.

For most workers, wages are still failing to keep up with inflation

While overall wages grew in line with inflation in the June quarter for workers in most industries real wages are still going backwards.

July 2023

We need more than a definition change to fix Australia’s culture of permanent ‘casual’ work

The surprising thing about the Albanese government’s announced reforms to “casual” employment is not that they’re happening.

Inflation is falling so let’s make sure we don’t let unemployment rise

Inflation is coming down fast so we should now shift our attention to making sure unemployment does not rise

Hollywood actors showing that unity is strength

When workers are united, and able to collectively bargain, they can win good outcomes

The key legislation changes that will help workers get a better deal

In recent years, workers have been held back from demanding better working conditions and pay by a lack of bargaining power.

General Enquiries

mail@australiainstitute.org.au

Media Enquiries

Luciana Lawe Davies Media Adviser

luciana@australiainstitute.org.au