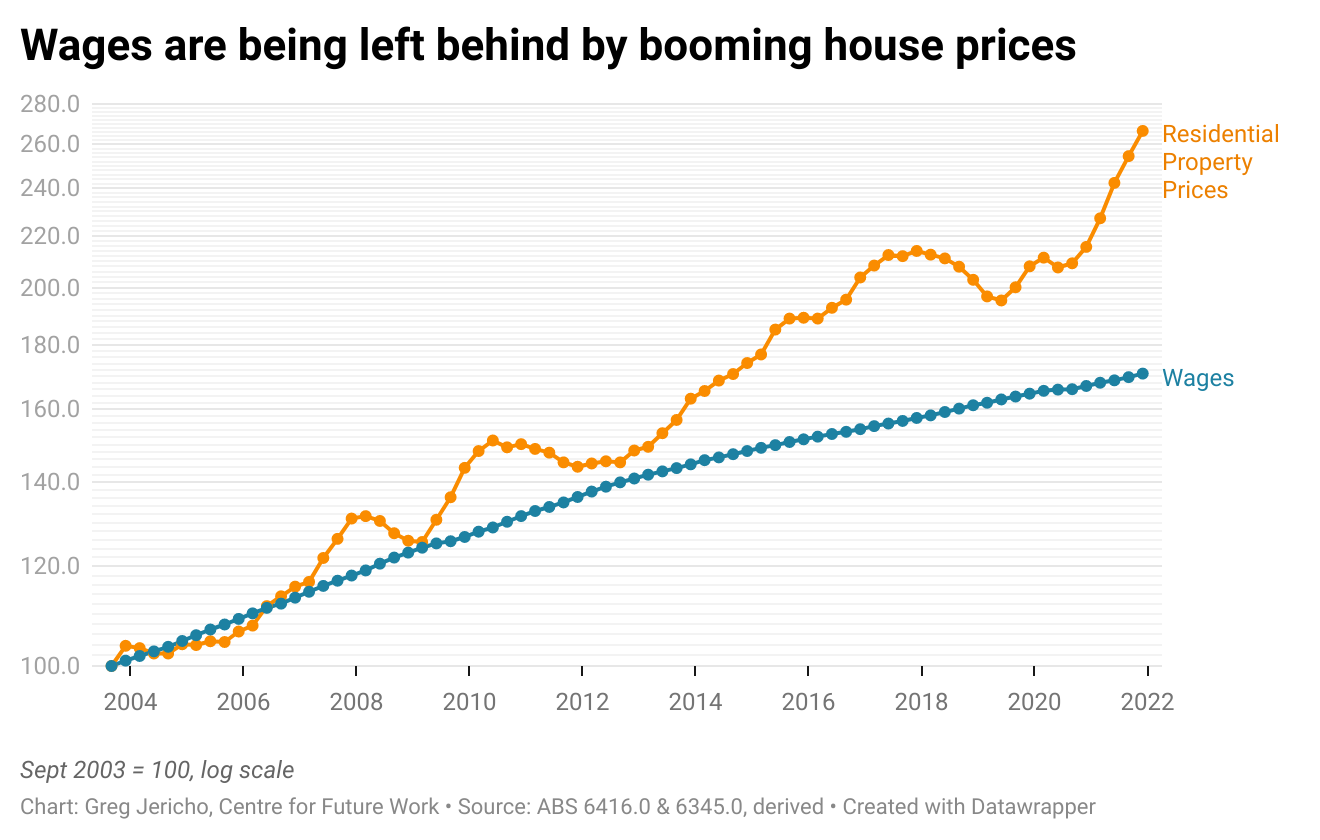

Since the stimulus measures introduced in 2020 to prop up the housing market during the pandemic, house prices have exploded. In 2021 property prices across Australia’s capital cities rose an astonishing 24%. Combined with the stagnant wages growth of the past 8 years, housing affordability has fallen dramatically.

A decade ago the medium-priced house in Sydney was equivalent to 5.8 times the annual income of a median household; now it is 10.8 times that income.

Greg Jericho examines the issue in his column in Guardian Australia and drills down to look at the affordability of housing across the nation and finds a shocking, yet unsurprising tale – and one that deserves a much greater focus in the coming election campaign than is currently the case

https://www.datawrapper.de/_/GmaeJ/

You might also like

The continuing irrelevance of minimum wages to future inflation

Minimum and award wages should grow by 5 to 9 per cent this year

Want to lift workers’ productivity? Let’s start with their bosses

Business representatives sit down today with government and others to talk about productivity. Who, according to those business representatives, will need to change the way they do things?

Feeling hopeless? You’re not alone. The untold story behind Australia’s plummeting standard of living

A new report on Australia’s standard of living has found that low real wages, underfunded public services and skyrocketing prices have left many families experiencing hardship and hopelessness.