The more than a decade long period of the Reserve Bank going without raising interest rates looks set to end. Rising inflation and the unwinding of the pandemic restrictions and border closures means that the emergency cash rate of 0.1% will soon go up. But at the moment the market expects before the end of next year that it will rise to above 3%.

But while that may have been a neutral rate in the past, the Centre’s Fiscal and Labour Market Policy Director Greg Jericho, notes in his column in Guardian Australia, recent surges in house prices means such a rise would place an extreme burdon on mortgage payers – one not conducive to an economy still in recovery.

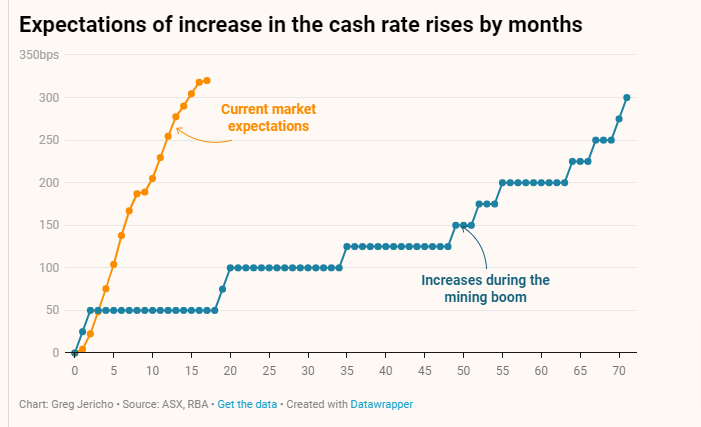

It took nearly 6 years during the mining boom for the RBA to raise the cash rate by 300 basis points; currently the market anticipates the same rise occurring in 17 months.

That would massively limit economic growth for little purpose at a time when wage rises remains below inflation, and rather unlikely to occur given the Reserve Bank’s recent hesitancy to slow the economy until real wage again start rising.

You might also like

Chalmers is right, the RBA has smashed the economy

In recent weeks the Treasurer Jim Chalmers has been criticised by the opposition and some conservative economists for pointing out that the 13 interest rate increases have slowed Australia’s economy. But the data shows he is right.

Analysis: Will 2025 be a good or bad year for women workers in Australia?

In 2024 we saw some welcome developments for working women, led by government reforms. Benefits from these changes will continue in 2025. However, this year, technological, social and political changes may challenge working women’s economic security and threaten progress towards gender equality at work Here’s our list of five areas we think will impact on

Would you like a recession with that? New Zealand shows the danger of high interest rates

New Zealand’s central bank raised interest rates more than Australia and went into a recession – twice.