On Wednesday the latest inflation figures showed that in the 12 months to September prices across Australia grew by 7.3% – the fastest rate since 1990.

The biggest concerns about the figures are that inflation is rising fastest for items that are non-discretionary, which means people are unable to avoid paying them – things like food, energy bills, transport costs, and health costs. As Labour market and fiscal policy Director, Greg Jericho, notes in his Guardian Australia column low-middle income earners have to spend a greater share of their income on these items than the average, which means they are hurt hardest.

The inflation figures also show that while house prices are still rising strongly, the rising interest rates are now starting to truly have an impact on rents. Rental prices across every capital city rose by more than 1% in the September quarter – the first time that has happened since 2007.

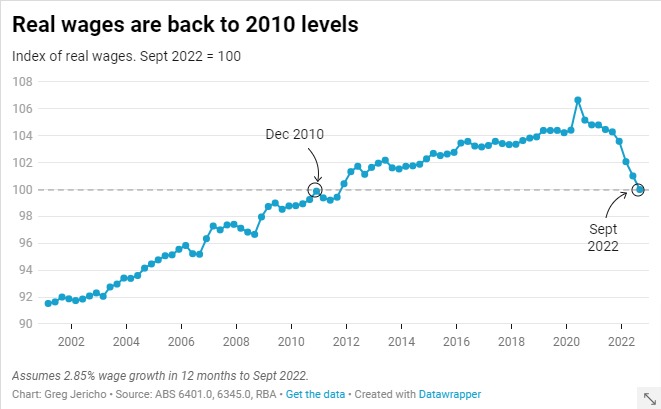

But the real damage of inflation is seen in relation to wage growth. The Reserve Bank estimates that wages in the 12 months to September will have grown just 2.85%. This means people’s ability to buy things with their wages has fallen over 4% in the past year. This is a massive drop in real wages and unfortunately, it is expected to continue at least until the middle to end of next year.

Right now real wages are back where they were 12 years ago. It is a damning indictment of the Industrial Relations system that has been designed to keep wages down. The Government today has introduced the Fair Work Legislation Amendment (Secure Jobs, Better Pay) Bill 2022 which seeks to provide workers with greater power to bargain for better wages. Given the latest figures, it is clear how urgently the changes are needed.

You might also like

The continuing irrelevance of minimum wages to future inflation

Minimum and award wages should grow by 5 to 9 per cent this year

Feeling hopeless? You’re not alone. The untold story behind Australia’s plummeting standard of living

A new report on Australia’s standard of living has found that low real wages, underfunded public services and skyrocketing prices have left many families experiencing hardship and hopelessness.

Go Home On Time Day 2025. As full timers disconnect, part timers are doing more unpaid overtime

New research by the Centre for Future Work at The Australia Institute has revealed a disturbing new twist when it comes to unpaid overtime in Australia.