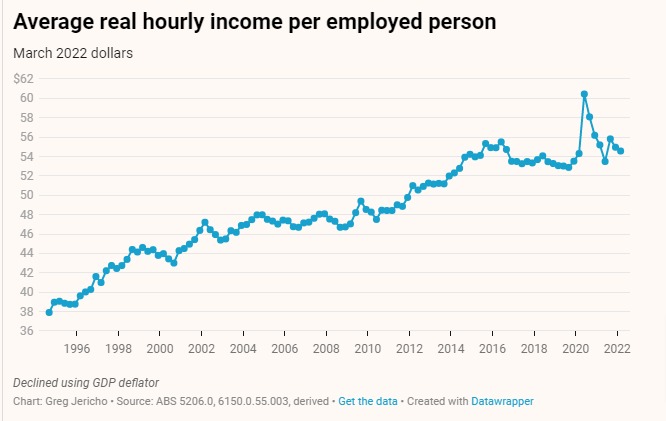

The latest labour account survey released by the Bureau of Statistics revealed that while job growth remains solid and the job vacancy rate is at record levels, workers real incomes remains at best flat.

As we now enter a phase where the Reserve Bank is raising interest rates in an effort to reduce demand in the economy and keep down inflation and prices and wages, labour market policy director, Greg Jericho, notes in his Guardian Australia column that workers risk seeing their real wages continue to fall.

It is clear that the major pressures for inflation have come not from labour costs but from the input costs of goods and material. While these costs have been passed on to consumers, there has been much less flow through to workers.

While the Reserve Bank notes that there are some signs of rising wages, these will inevitably be reduced due to the impacts of rising interest rates.

After a year in which real wages have plummeted, the recovery is very much looking like one where company profits have risen, but where workers will miss out on wage growth that would undo the damage of the past year.

You might also like

The continuing irrelevance of minimum wages to future inflation

Minimum and award wages should grow by 5 to 9 per cent this year

Want to lift workers’ productivity? Let’s start with their bosses

Business representatives sit down today with government and others to talk about productivity. Who, according to those business representatives, will need to change the way they do things?

A smooth move or a tough transition? Protecting workers who’ll lose their jobs when the Eraring Power Station closes

The Centre for Future Work at The Australia Institute has urged the federal government to take charge of transitioning hundreds of workers into secure employment when the Eraring Power Station shuts down.