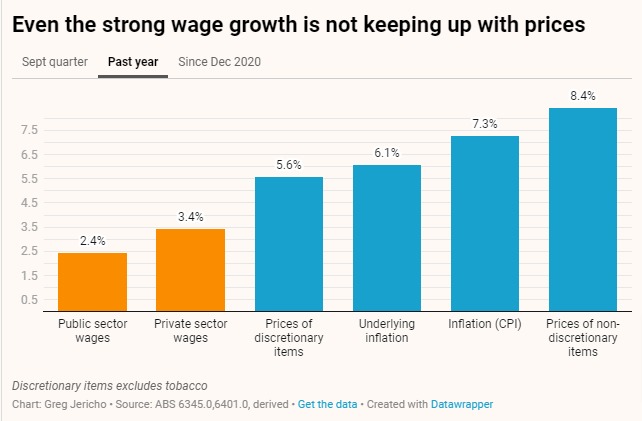

The latest wages price index figures show that for the first time since 2013 wages grew by more than 3% in the past year.

This growth is very welcome. It highlights that far from wages driving inflation, wage growth is only now beginning to grow at a pace that would be expected given the low level of unemployment. But as Labour Market and Fiscal Policy Director, Greg Jericho notes in his Guardian Australia column, while the level of wage growth we are seeing remains well below what would have been expected in the past with a 3.5% unemployment rate.

The strong growth came mostly from the private sector through a combination of new financial year individual contracts and the 5.2% minimum wage increase.

But even this is not enough to prevent real wages from falling for the 9th straight quarter. For more than 2 years now prices have been rising faster the wages. It has seen real wages fall back to 2011 levels after a 4.6% fall since September 2020.

The figures show that greater bargaining power is required for workers as they continue to lose out. The fastest wage growth for a decade should not see the biggest fall in real wages on record.

We know that greater enterprise bargaining producers better wages growth. That business groups are so against the provision in the Fair Work Amendment Bill demonstrates how worried they are about the ability of workers to have increased ability to bargain.

Profits have been growing faster than inflation, but wages are not.

The latest wage growth figures are pleasing to see, but they also demonstrate the challenges ahead, and just how greatly workers’ living standards have been hit by price rises that they did nothing to cause.

You might also like

The continuing irrelevance of minimum wages to future inflation

Minimum and award wages should grow by 5 to 9 per cent this year

Australia does not have a “productivity crisis” – new research

New research by The Australia Institute reveals there is little evidence of a “productivity crisis” in Australia, despite claims to the contrary from business leaders and politicians.

Want to lift workers’ productivity? Let’s start with their bosses

Business representatives sit down today with government and others to talk about productivity. Who, according to those business representatives, will need to change the way they do things?