This week the IMF released its latest World Economic Outlook. And the outlook is dire. Economic growth around the world was downgraded with recession-like conditions being predicted for many advanced economies including the USA, UK and much of the EU.

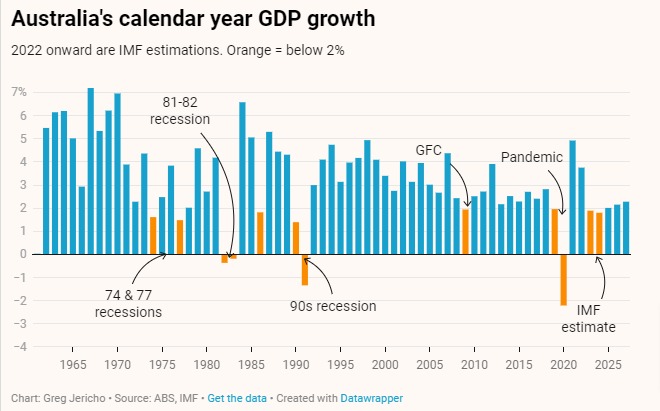

As policy director, Greg Jericho, notes in his Guardian Australia column, the outlook is not much better for Australia. The IMF is now predicting that in 2023 and 2024 Australia’s GDP will grow less than 2%. Such meagre growth in the past has been consistent with periods of recession.

The report should serve as a stark warning to central banks around the world that their efforts to limit inflation by sharply raising interest rates is becoming more and more likely to end with a recession and the resultant massive loss of jobs that will follow. Experience from the 1980s and 1990s where similar recessions followed extreme tightening of monetary policy suggests it can take a long time to reverse the damage.

While the Reserve Bank is somewhat constrained because it needs to be mindful of the rate rises in the USA that weaken the value of the Australian dollar, the IMF report should cause them to weigh much more the costs of sharply slowing growth through interest rate rises.

We know that current efforts to limit inflation growth are mostly involving workers taking a real wage hit. Having to endure rising unemployment and a recession after 2 years of already extreme falls in living standards would be disastrous, especially while profits continue to rise.

You might also like

The continuing irrelevance of minimum wages to future inflation

Minimum and award wages should grow by 5 to 9 per cent this year

Want to lift workers’ productivity? Let’s start with their bosses

Business representatives sit down today with government and others to talk about productivity. Who, according to those business representatives, will need to change the way they do things?

Dutton’s nuclear push will cost renewable jobs

Dutton’s nuclear push will cost renewable jobs As Australia’s federal election campaign has finally begun, opposition leader Peter Dutton’s proposal to spend hundreds of billions in public money to build seven nuclear power plants across the country has been carefully scrutinized. The technological unfeasibility, staggering cost, and scant detail of the Coalition’s nuclear proposal have