News // Greg Jericho

September 2024

Chalmers is right, the RBA has smashed the economy

In recent weeks the Treasurer Jim Chalmers has been criticised by the opposition and some conservative economists for pointing out that the 13 interest rate increases have slowed Australia’s economy. But the data shows he is right.

June 2024

No need for panic over ‘sticky’ inflation: Jericho

Inflation has stopped falling, but there’s no need for a further rate hike, says Greg Jericho.

May 2024

Calls for massive rate hikes and recession are cavalier: Jericho

Inflation will remain higher for longer, but a recession is not the solution, says Greg Jericho.

Increasing JobSeeker is possible, it’s just a question of priorities

The government has the power to make significant and long-awaited improvements to the JobSeeker scheme in this federal budget, but it has to make it a priority, says Greg Jericho.

April 2024

Who’s hurting most from rising interest rates? It’s probably you.

Soaring house prices, high household debt and the pervasiveness of variable rate home loans mean that Australians bear the brunt of interest rate rises, says Greg Jericho.

Australia’s “stupid” surplus obsession must end

A budget surplus doesn’t mean a government is good at running the economy – we should focus on the choices they make instead, says Greg Jericho.

“It’s a scare campaign”: award wage rise won’t trigger inflation spiral

With unions calling for a five per cent increase to award wages, business groups are crying wolf over the proposal’s impact on inflation and unemployment, says Greg Jericho.

March 2024

The RBA should keep its finger off the interest rate trigger

With unemployment tumbling in February, the Reserve Bank of Australia (RBA) should resist the urge to raise interest rates, says Australia Institute Chief Economist Greg Jericho.

February 2024

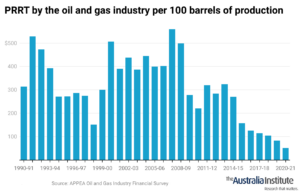

The gas industry is laughing at us as they make more money but not more tax

Despite soaring production and revenues the gas industry is not paying more tax

December 2023

Higher exports prices improve the budget, but the Stage 3 tax cuts remain the wrong tax at the wrong time

As the Budget outlook improves, with most of the benefits of Stage 3 tax cuts going to those earing over $120,000, over 80% of workers will be short-changed

November 2023

After two years of profit-led inflation, workers deserve the pay rises they are getting

The wage rises for low-paid workers on awards and those working in aged care helped drive the strong wage growth.

The Government needs to act on Stage 3 as the RBA warns about wealthy households spending

The RBA made it clear one group continues to do well, and continue to spend – and they are also the ones who are about to get a massive tax cut.

When the prices of necessities are rising fast, the RBA does not need to hit households with another rate rise

Cost of living rose by more than inflation because of interest rate rises. Another rate rise would only cause more unnecessary pain.

October 2023

The Reserve Bank should not raise rates on Melbourne Cup Day

Inflation is being driven by things unaffected by interest rate, so there is no reason for the RBA to raise rates in November

Australia is an energy super power, we need to use that power for good

Australia is already an energy superpower, but our governments have lacked the courage to use that power to reduce greenhouse gas emissions

The latest report from the IMF highlights the need for full-employment to be the aim of the government and the Reserve Bank

If the economy grows as slowly as the IMF predicts it will for the next 2 years, Australia will be lucky to avoid a recession.

September 2023

Inflation remains headed in the right direction despite higher oil prices

Increases in the prices of commodities like oil and gas are not a reason for the RBA to raise interest rates next week

Opening statement to the ACTU Price Gouging Inquiry

This week Professor Allan Fels, the former head of the Australian Competition and Consumer Commission (ACCC), has begun an inquiry into price gouging across a range of industries, including banks, insurance companies, supermarkets, and energy providers. The inquiry commissioned by the ACTU comes off the back of the highest inflation in 30 years and the biggest falls in real wages on record.

The weak economy shows the Reserve Bank is not threading the needle

We have now had two consecutive quarters of GDP per capita falling – hardly the soft landing the RBA wants.

August 2023

Australia’s emissions are rising at a time they need to fall quickly

The latest quarterly greenhouse gas emissions survey shows that Australia is heading in the wrong direction – and that needs calling out.

For most workers, wages are still failing to keep up with inflation

While overall wages grew in line with inflation in the June quarter for workers in most industries real wages are still going backwards.

July 2023

Inflation is falling so let’s make sure we don’t let unemployment rise

Inflation is coming down fast so we should now shift our attention to making sure unemployment does not rise

Hollywood actors showing that unity is strength

When workers are united, and able to collectively bargain, they can win good outcomes

If the unemployment rises to 4.5% who is likely to lose their job?

The RBA is currently targeting a 4.5% unemployment rate, and that is going to hurt young, low skilled and low paid workers,

June 2023

Bolstered by a biased tax system, house prices keep rising

As interest rates rise, the gains from negative gearing increase.

The economy is slowing as households get smashed by yet more rate rises

A slowing economy and households closing their wallets is bad news with a Reserve Bank determined to keep raising rates

The level of public housing needs to return to previous levels

Australia needs more housing, and we definitely need more public housing

May 2023

Real wages falls and interest rates rises signal tough times for households and the economy

You can’t sustain household spending while real wages continue to fall, and households are starting to let everyone know

Wages are growing solidly but real wages continue to plummet

Wages are growing the best they have for 11 years, but real wages are now back at the level they were 14 years ago

Don’t worry about a budget surplus, worry about a slowing economy

Rather than be a budget that will fuel inflation, the budget is actually closer to austerity than stimulation

General Enquiries

mail@australiainstitute.org.au

Media Enquiries

Glenn Connley Senior Media Adviser

glenn.connley@australiainstitute.org.au