News

March 2024

Fixing the work and care crisis means tackling insecure and unpredictable work

The Fair Work Commission is examining how to reduce insecurity and unpredictability in part-time and casual work to help employees better balance work and care. The Commission is reviewing modern awards that set out terms and conditions of employment for many working Australians to consider how workplace relations settings in awards impact on work and

Aged care wage rise decision crucial for elderly Australians

The Australia Institute says wage rises for aged care workers will improve the lives of elderly Australians after a crucial Fair Work Commission decision.

Most Coalition voters back right to disconnect

Two-thirds of Coalition voters back newly legislated protections for employees’ right to disconnect from emails and calls outside of work, new research from the Australia Institute shows.

On International Women’s Day: How the Fair Work Commission Can Really Take On the Gender Pay Gap

On occasion of International Women’s Day, the Centre for Future Work’s Senior Researcher Lisa Heap reviews the opportunities to use recent industrial relations reforms to more ambitiously address Australia’s gender pay gap.

Aged care reforms fall short on quality, safety

Mandating sector-wide aged care training requirements would make elderly Australians safer while bolstering workforce stability, according to a new analysis by the Australia Institute.

February 2024

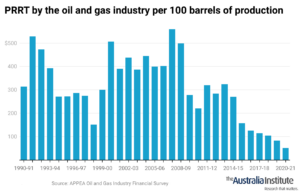

The gas industry is laughing at us as they make more money but not more tax

Despite soaring production and revenues the gas industry is not paying more tax

More loopholes to close on insecure work … and a new right to disconnect from work

Late yesterday the final part 2 of the government’s Closing Loopholes industrial relations bill was passed by the Senate.

“Right to Disconnect” Essential as Devices Intrude Into Workers’ Lives

Australia’s Parliament is set to pass a new set of reforms to the Fair Work Act and other labour laws, that would enshrine certain protections for workers against being contacted or ordered to perform work outside of normal working hours. This “Right to Disconnect” is an important step in limiting the steady encroachment of work

Fels’ Review Confirms Corporate Practices As Key Drivers of Inflation

The Australia Institute welcomes the report of the Inquiry Into Price Gouging and Unfair Pricing Practices, chaired by Prof Allan Fels, and delivered today to the Australian Council of Trade Unions.

January 2024

We Cannot Truly Value ‘Care’ Until Workers Using Digital Labour Platforms Get Fair Pay and Conditions

Unless minimum employment standards for care and support workers using digital labour platforms are guaranteed, decades of slow progress towards proper recognition of care work and equal pay for women could be undone.

December 2023

Closing Loopholes: Important repairs to the industrial relations system, no more, no less

Labour hire workers can no longer be paid less than employees doing the same job in their workplaces as a result of industrial reforms passed by Parliament. However, other important reforms to close loopholes in employment laws and stop exploitation of workers and avoidance of standards won’t be voted on in Parliament until next year.

New Report Reveals Changing Face and Future of Self-Employment

A new report by the Australia Institute shows self-employment in Australia has changed in recent years, towards fewer business owners and more gig work.

Special Issue of Journal Marks Halfway Point of First Albanese Government

The Journal of Australian Political Economy, a peer-reviewed journal based at the University of Sydney, has today published a special issue evaluating the record of the Albanese government during the first half of its term in office.

The Stage 3 tax cuts will make our bad tax system worse

Australia has one of the weakest tax systems for redistribution among industrial nations, and as Dr Jim Stanford writes, the Stage 3 tax cuts will make it worse.

Higher exports prices improve the budget, but the Stage 3 tax cuts remain the wrong tax at the wrong time

As the Budget outlook improves, with most of the benefits of Stage 3 tax cuts going to those earing over $120,000, over 80% of workers will be short-changed

Paying for Collective Bargaining

Recent labour law reforms in Australia have focused attention on the crucial role played by collective bargaining in achieving higher wages, safer working conditions, and better job security.

Solidarity Research for Union Renewal

A Symposium of Researchers and Trade Unionists co-hosted by the Centre for Future Work and Unions WA.

November 2023

Employers Steal More than 280 Hours from Workers Each Year: Go Home on Time Day Report 2023

Despite record-low unemployment, Australian employers are still managing to steal more than 280 hours from their employees each year.

After two years of profit-led inflation, workers deserve the pay rises they are getting

The wage rises for low-paid workers on awards and those working in aged care helped drive the strong wage growth.

The Government needs to act on Stage 3 as the RBA warns about wealthy households spending

The RBA made it clear one group continues to do well, and continue to spend – and they are also the ones who are about to get a massive tax cut.

When the prices of necessities are rising fast, the RBA does not need to hit households with another rate rise

Cost of living rose by more than inflation because of interest rate rises. Another rate rise would only cause more unnecessary pain.

October 2023

The Reserve Bank should not raise rates on Melbourne Cup Day

Inflation is being driven by things unaffected by interest rate, so there is no reason for the RBA to raise rates in November

Australia is an energy super power, we need to use that power for good

Australia is already an energy superpower, but our governments have lacked the courage to use that power to reduce greenhouse gas emissions

The latest report from the IMF highlights the need for full-employment to be the aim of the government and the Reserve Bank

If the economy grows as slowly as the IMF predicts it will for the next 2 years, Australia will be lucky to avoid a recession.

Insecure work is a feature of our labour market. New laws can change that.

Chris Wright is Associate Professor in the Discipline of Work and Organisational Studies at the University of Sydney, and a member of the Centre for Future Work’s Advisory Committee. This commentary is based on his submission to the Senate Education and Employment Legislation Committee’s inquiry into the Fair Work Legislation Amendment (Closing Loopholes) Bill 2023,

September 2023

Inflation remains headed in the right direction despite higher oil prices

Increases in the prices of commodities like oil and gas are not a reason for the RBA to raise interest rates next week

Opening statement to the ACTU Price Gouging Inquiry

This week Professor Allan Fels, the former head of the Australian Competition and Consumer Commission (ACCC), has begun an inquiry into price gouging across a range of industries, including banks, insurance companies, supermarkets, and energy providers. The inquiry commissioned by the ACTU comes off the back of the highest inflation in 30 years and the biggest falls in real wages on record.

Deteriorating Disability Worker Pay, Conditions Undermining NDIS

An urgent overhaul of poorly paid and casualised disability support work is needed to ensure the National Disability Insurance Scheme’s viability and protect participants from substandard care, a new report by the Australia Institute’s Centre for Future Work says.

Corporate Profits Must Take Hit to Save Workers

Historically high corporate profits must take a hit if workers are to claw back real wage losses from the inflationary crisis, according to new research from the Australia Institute’s Centre for Future Work.

Millionaire Tim Gurner’s Refreshing Honesty Reveals the Soul of Business

Every now and then a window opens into the soul of the business community, and we catch a glimpse of the values and goals that shape the actions of the captains of industry.

General Enquiries

mail@australiainstitute.org.au

Media Enquiries

Glenn Connley Senior Media Adviser

glenn.connley@australiainstitute.org.au