The Stage 3 tax cuts will cost $300bn in their first 9 years. A new tool shows how we can spend the money better

Just before Christmas last month the Parliamentary Budget Office released a “Build Your Own Budget” tool that reveals the interactions of taxes, spending and economic conditions that go into determining the budget balance.

While the tool is an invaluable device for economists, its real value as noted by Labour Market and Fiscal Policy Director Greg Jericho, is how it highlights the massive cost of the Stage 3 tax cuts.

In his Guardian Australian column, Jericho notes that the Stage 3 tax debate has become about all-or-nothing rather than realising the $300bn cost of the tax cuts over 9 years provides an opportunity for the Albanese government to amend the tax cuts and also increase support for benefits and government services.

The Stage 3 tax cuts are so expensive that the PBO’s budget tool reveals you could raise Jobseeker from its current rate of $668 a fortnight to $1,925 and the budget deficit in 2032-33 would still be lower than it is currently predicted to be with the Stage 3 tax cuts.

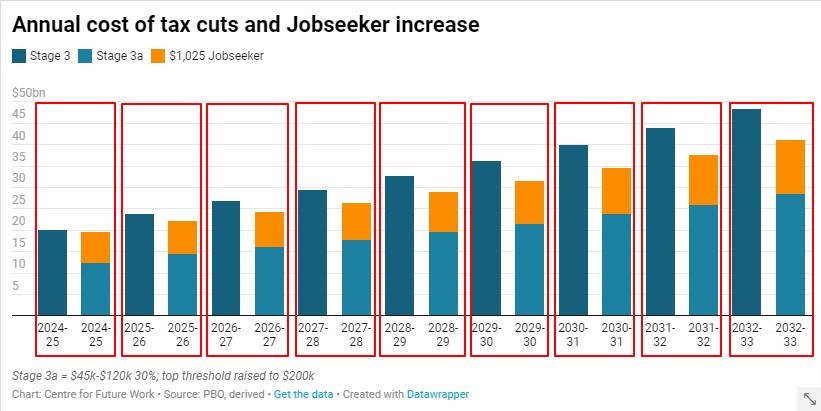

The Stage 3 tax cuts could be amended to reduce the 32.5% tax rate for earnings between $45,000 to $120,000 to 30% and still raise the top tax threshold from $180,000 to $200,000. These still very large tax cuts would cost $120bn less over the first 9 years than would the Stage 3 cuts. That would enable the government to, for example, increase Jobseeker to $1,025 and still have a better budget position than current predicted with the Stage 3 cuts.

This highlights just how many options are available to the government.

Budget are about choices, government is about choices. The Albanese government has a massive choice to make – either continue with the Stage 3 tax cuts that massive hit the budget for little reason other than to hand wealthy people a huge tax cut, or it can take this opportunity to create a fairer economy and society.

You might also like

Commonwealth Budget 2025-2026: Our analysis

The Centre for Future Work’s research team has analysed the Commonwealth Government’s budget, focusing on key areas for workers, working lives, and labour markets. As expected with a Federal election looming, the budget is not a horror one of austerity. However, the 2025-2026 budget is characterised by the absence of any significant initiatives. There is

Want to lift workers’ productivity? Let’s start with their bosses

Business representatives sit down today with government and others to talk about productivity. Who, according to those business representatives, will need to change the way they do things?

Australia does not have a “productivity crisis” – new research

New research by The Australia Institute reveals there is little evidence of a “productivity crisis” in Australia, despite claims to the contrary from business leaders and politicians.