Australia’s “stupid” surplus obsession must end

A budget surplus doesn’t mean a government is good at running the economy – we should focus on the choices they make instead, says Greg Jericho.

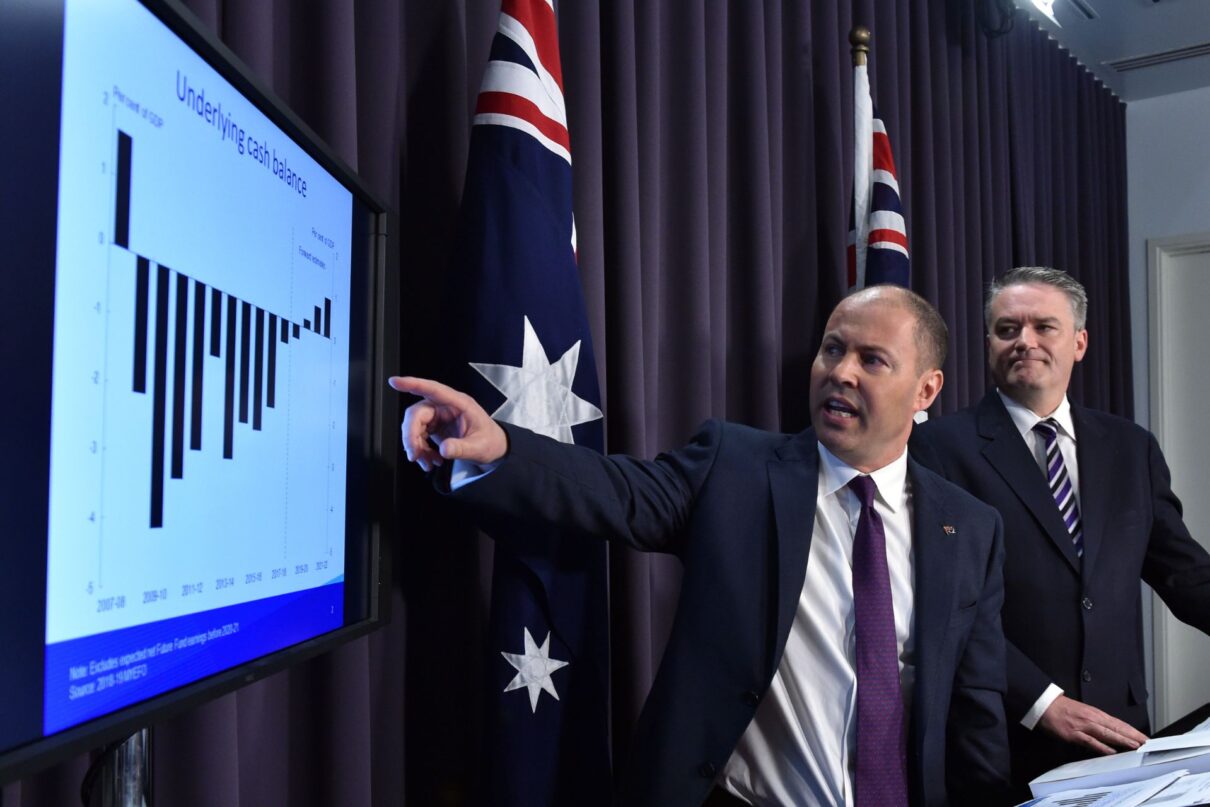

Australian governments like to brag about their big budget surpluses — one even slapped it on a mug — but they aren’t all they’re cracked up to be, according to Chief Economist at the Australia Institute, Greg Jericho.

“I think the discussion about budget surpluses and deficits is quite stupid, to be blunt,” he said on the latest episode of Dollars & Sense.

The accuracy of budget projections is highly dependent on commodity prices, international economic conditions and other factors outside a government’s control, making them notoriously difficult to get right.

“It’s a fairly complicated thing, the Australian economy. There are lots of moving parts and they never get it right,” Jericho said.

“Last year, in the May budget, there were essentially two months to go in the 2022-23 financial year, so you’d think they can’t get the figure that wrong. Treasury estimated that the budget was going to be in surplus by $4 billion.

“When we got complete figures in September…they found out, no — it wasn’t $4 billion, it was $22 billion!

“If they can be that wrong with two months to go, think how wrong they can be 12 months ahead, four years ahead.”

When getting excited about the Budget numbers on the first Tuesday in May, just remember, they will most likely be wronghttps://t.co/puKj8elgcL pic.twitter.com/WN4lIX0FbT

— Greg Jericho (@GrogsGamut) April 3, 2024

Jericho said it’s “absurd” to suggest a surplus or deficit alone reveals if a government is managing the economy effectively.

“It started with Paul Keating and then Peter Costello really set fire to it because he was Treasurer during a massive mining boom, where there were masses of tax revenue coming in, making it very easy to be in a surplus.

“He wanted to be able to sell that as being really good and he was this great economic manager.”

But like household debt, a national deficit can be good if used to invest in the future, Jericho argued.

“What if that deficit was used to build a hospital?

“Our children, and our children’s children, are going to be using that hospital — would you prefer they didn’t build it?

It’s not just about expenditure, he said, because budgets also reflect a government’s priorities in how it raises revenue.

“Let’s say we raised $5 billion more from the Petroleum Resources Rent Tax — that means we could reduce the tax on individuals by $5 billion with no change in the budget balance.

“Or we could spend that money on health or education.

“Budgets are very much about choices.”

Dollars & Sense is available on Spotify, Apple Podcasts, Google Podcasts or wherever you get your podcasts.

You might also like

Commonwealth Budget 2025-2026: Our analysis

The Centre for Future Work’s research team has analysed the Commonwealth Government’s budget, focusing on key areas for workers, working lives, and labour markets. As expected with a Federal election looming, the budget is not a horror one of austerity. However, the 2025-2026 budget is characterised by the absence of any significant initiatives. There is

Want to lift workers’ productivity? Let’s start with their bosses

Business representatives sit down today with government and others to talk about productivity. Who, according to those business representatives, will need to change the way they do things?

Centre For Future Work to evolve into standalone entity

The Centre for Future Work was established by the Australia Institute in 2016 to conduct and publish progressive economic research on work, employment, and labour markets. Supported by the Australian Union movement, the centre produced cutting edge research and led the national conversation on economic issues facing working people: including the future of jobs, wages