The more than a decade long period of the Reserve Bank going without raising interest rates looks set to end. Rising inflation and the unwinding of the pandemic restrictions and border closures means that the emergency cash rate of 0.1% will soon go up. But at the moment the market expects before the end of next year that it will rise to above 3%.

But while that may have been a neutral rate in the past, the Centre’s Fiscal and Labour Market Policy Director Greg Jericho, notes in his column in Guardian Australia, recent surges in house prices means such a rise would place an extreme burdon on mortgage payers – one not conducive to an economy still in recovery.

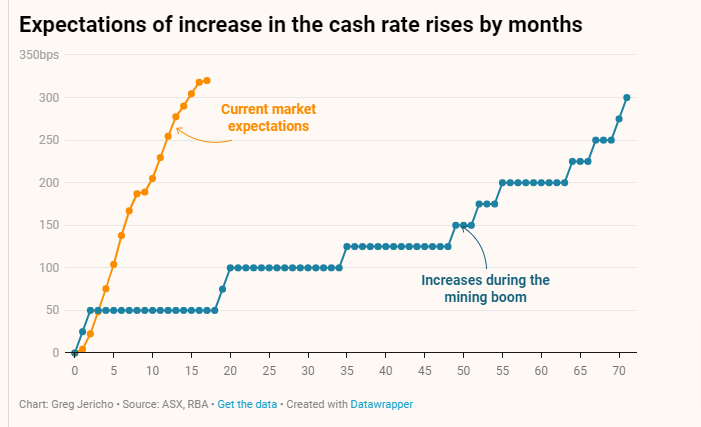

It took nearly 6 years during the mining boom for the RBA to raise the cash rate by 300 basis points; currently the market anticipates the same rise occurring in 17 months.

That would massively limit economic growth for little purpose at a time when wage rises remains below inflation, and rather unlikely to occur given the Reserve Bank’s recent hesitancy to slow the economy until real wage again start rising.

You might also like

Climate crisis escalates cost-of-living pressures

A new report has found direct connections between the climate crisis and rising cost-of-living pressures. Failure to lower emissions now will only aggravate the crisis, with each moment of inaction compounding the pressure on households.

A smooth move or a tough transition? Protecting workers who’ll lose their jobs when the Eraring Power Station closes

The Centre for Future Work at The Australia Institute has urged the federal government to take charge of transitioning hundreds of workers into secure employment when the Eraring Power Station shuts down.

Dutton’s nuclear push will cost renewable jobs

Dutton’s nuclear push will cost renewable jobs As Australia’s federal election campaign has finally begun, opposition leader Peter Dutton’s proposal to spend hundreds of billions in public money to build seven nuclear power plants across the country has been carefully scrutinized. The technological unfeasibility, staggering cost, and scant detail of the Coalition’s nuclear proposal have