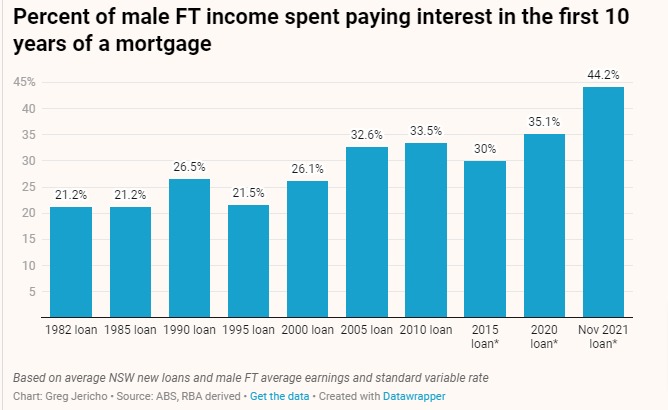

For most of the past decade the talk about housing affordability has focussed on house prices. As fiscal policy director, Greg Jericho notes in his Guardian Australia column, falling interest rates since November 2010 have made paying off a mortgage less onerous than it otherwise would have given the soaring house prices.

But that is about to change.

The signal that interest rates are going to rise by possibly 2.5% points over the next 18 months means that for new mortgage holders the cost of repaying a mortgage is going to be harder than ever before – harder even than when interest rates hit 17% in 1990.

It is a hit that will only exacerbate standard of living problems as wages will struggle to keep up with the rising cost of of holding a mortgage – especially given the belief that wage rises need to be contained below inflation rises continues in economic debate.

You might also like

Go Home On Time Day 2025. As full timers disconnect, part timers are doing more unpaid overtime

New research by the Centre for Future Work at The Australia Institute has revealed a disturbing new twist when it comes to unpaid overtime in Australia.

Want to lift workers’ productivity? Let’s start with their bosses

Business representatives sit down today with government and others to talk about productivity. Who, according to those business representatives, will need to change the way they do things?

The continuing irrelevance of minimum wages to future inflation

Minimum and award wages should grow by 5 to 9 per cent this year