Scare Tactics for Corporate Tax Cuts Do Not Stand Fact Checks

In the wake of the Trump Administration’s success in pushing a major company tax cut through the U.S. Congress, the Australian Treasurer has stepped up his calls for reduced company taxes here. He claims Australia will bypass the growth-inducing benefits of these tax cuts, but Dr. Anis Chowdhury, Associate of the Centre for Future Work, has compiled the economic evidence. The U.S. experience shows no statistical evidence of any “trickle-down” growth dividend from company tax cuts.

“Trump tax cuts: Scott Morrison warns business will abandon Australia while we are at the beach” was the Sydney Morning Herald headline, reporting on the Coalition Government’s scare tactics to press through its tax cuts gift for business. The Treasurer used the opportunity of the Trump tax cuts to issue this “dire” warning. However, his claim does not withstand some basic empirical scrutiny.

Fact 1: Australia is not a high tax country

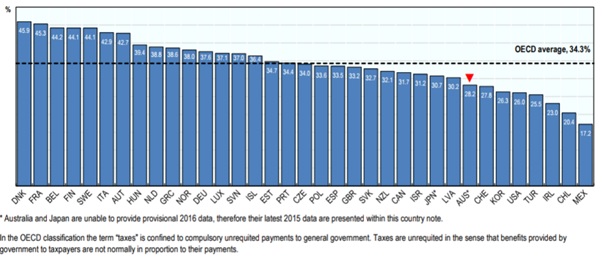

Our overall tax take is one of the lowest among the 35 OECD countries. If Mr. Morrison was correct, then by now there should have been a tsunami of investment flowing here from 27 OECD countries with higher tax-GDP ratios than that of Australia’s 28.2% in 2016. Australia’s overall tax ratio is well below the OECD average of 34%, and also below neighbouring New Zealand’s tax take of 32.1% of GDP.

Here are reported tax ratios for 27 OECD countries, 2016.

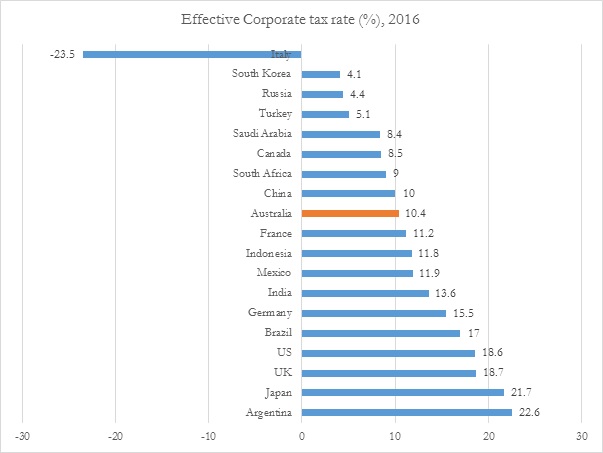

Fact 2: Australia’s effective corporate tax is far below its statutory 30% rate

Australian companies may seem to face a higher statutory corporate tax rate, but once they go through all their deductions and credits they don’t end up paying an unusually high amount compared to companies in other nations. The average effective rate (10.4%) is barely one-third the statutory rate. In fact, more than a third of large companies did not pay any corporate taxes in 2016 according to the recently released ATO data.

Fact 3: Tax is low on companies’ lists of factors influencing investment location decision

For example, the OECD noted, “it is not always clear that a tax reduction is required (or is able) to attract FDI. Where a higher corporate tax burden is matched by well-developed infrastructure, public services and other host country attributes attractive to business… tax competition from relatively low-tax countries not offering similar advantages may not seriously affect location choice. Indeed, a number of large OECD countries with relatively high effective tax rates are very successful in attracting FDI.”

This is corroborated by the most recent World Bank survey of enterprises, which found that tax incentives are not high on the list of critical factors affecting inflows of foreign direct investment. The IMF’s recent research also reports that the net impact of corporate tax cuts to incentivise private investment is quite often negative on government revenues. The pre-tax profitability of Australian businesses has also tended to exceed that in other countries, and this is surely more important in motivating investment flows.

Fact 4: Rigorous studies of past US tax cuts did not find a positive link between tax cuts and economic or employment growth

For example, the oft-cited examples of the Reagan or Bush tax cuts do not in fact demonstrate that tax cuts cause growth. Admitted by President Reagan’s former chief economist, Martin Feldstein, the vast majority of growth during the Reagan era was due to expansionary monetary policy that slashed interest rates massively to help the economy bounce back from a severe recession in 1982. Increased defence spending and an expanded labour force due to an influx of baby boomers also boosted the economy. In another study with Doug Elmendorf, the former Congressional Budget Office Director, Martin Feldstein found no evidence that the 1981 tax cuts increased employment.

The 2001 and 2003 Bush tax cuts also failed to spur growth. Between 2001 and 2007 the economy grew at a lacklustre pace—real per-capita income rose by 1.5% annually, compared to 2.3% over the 1950-2001 period. Interestingly, the two sectors that grew most rapidly in this period were housing and finance, which were not affected by the 2001 and 2003 tax cuts. Moreover, by 2006, prime-age males were working the same hours as in 2000 (before the tax cuts), and women were working less – both facts inconsistent with the view that lower tax rates raise labour supply.

Fact 5: The most infamous case of tax cuts in the US State of Kansas was a colossal failure

Governor Sam Brownback promised that a moderate tax cut for individuals and a big tax cut for businesses would be “like a shot of adrenaline into the heart of the Kansas economy.” Unfortunately, however, despite his 2012 tax cuts, the Kansas economy remained moribund, while neighbouring states surged ahead. In the process, the Kansas state budget was left in tatters. No wonder that the Republican-led state legislature reversed most of Brownback’s tax cuts in the face of poor growth and pressing public spending needs.

Therefore, if Mr. Morrison is serious about repairing the budget, or stimulating growth and employment, then he should be concentrating on raising more revenues (not less) and investing in the nation – instead of cutting basic services to fund his tax cuts for the rich. He should be looking at the facts, instead of resorting to scare tactics.

You might also like

Commonwealth Budget 2025-2026: Our analysis

The Centre for Future Work’s research team has analysed the Commonwealth Government’s budget, focusing on key areas for workers, working lives, and labour markets. As expected with a Federal election looming, the budget is not a horror one of austerity. However, the 2025-2026 budget is characterised by the absence of any significant initiatives. There is

Analysis: Will 2025 be a good or bad year for women workers in Australia?

In 2024 we saw some welcome developments for working women, led by government reforms. Benefits from these changes will continue in 2025. However, this year, technological, social and political changes may challenge working women’s economic security and threaten progress towards gender equality at work Here’s our list of five areas we think will impact on

Closing Loopholes Protections, Including Right to Disconnect, Come Into Effect 26 August

New labour rights coming into effect on 26 August, including the ‘Right to Disconnect’.