Despite soaring production and revenues the gas industry is not paying more tax

Australia produces more than six times the amount of gas needed to supply our manufacturing industry, power stations and homes. But more than 80% either heads overseas as LNG exports or is used to convert natural gas into LNG:

We export much more gas than we used to. In the 2000s we exported around 14m tonnes of LNG a year. Now, due to the opening of the Gladstone LNG terminal, we send 83mt overseas – the second most of any nation.

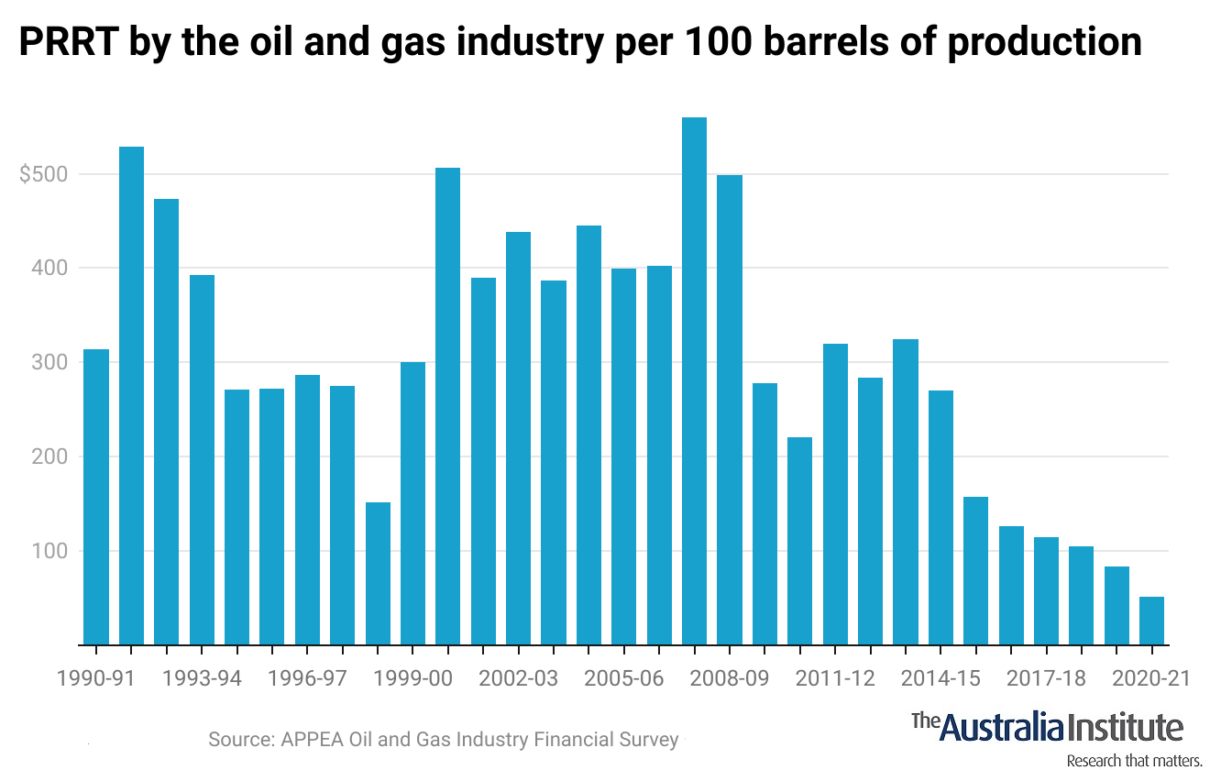

But more production and more revenue has not led to more tax, even though the petroleum resources rent tax (PRRT) is in place to supposedly raise revenue from windfall profits such as those generated by the gas industry after the Russian invasion of Ukraine.

When Australia exported 15.4mt of LNG in 2008-09, the government raised $2.2bn in PRRT. In 2022-23, exports had increased 437% to 83mt but PRRT revenue was up just 7% to $2.4bn.

Did gas suddenly become unprofitable?

No, the problem is that the PRRT is open to manipulation that enables companies to use costs to reduce their PRRT liability such that it appears they are never making “super profits”.

In last year’s budget, the government finally proposed limiting the deductions to the PRRT in any year to 90% of LNG project revenues. Alas that proposal also had a punchline. The government announced the changes would raise an extra $2.4bn in PRRT over the next four years. That was roughly a 30% increase in tax.

Thirty per cent!

You would think the gas industry would launch the mother of all campaigns against it. But no. They loved it.

The day it was announced the gas industry peak body recommended bipartisan support as the changes “would see more revenue collected earlier”. The key word was “earlier”. It won’t raise more tax; it just moves some tax from later to earlier.

But it won’t even do that.

In December’s midyear economic and fiscal outlook, the government announced it was revising down its estimate of how much PRRT would be raised over the next four years.

How much did it reduce its estimate by?

You guessed it: $2.4bn.

We need to change the way the PRRT operates, we need to tax our gas more and we need to do it now.

You might also like

Australia’s Gas Use On The Slide

The Federal Government has released a new report that includes projections of how much gas Australia is set to use over the coming decades. There is no ambiguity in its message: Australia reached peak gas years ago, and it’s all downhill from here:

Commonwealth Budget 2025-2026: Our analysis

The Centre for Future Work’s research team has analysed the Commonwealth Government’s budget, focusing on key areas for workers, working lives, and labour markets. As expected with a Federal election looming, the budget is not a horror one of austerity. However, the 2025-2026 budget is characterised by the absence of any significant initiatives. There is

A smooth move or a tough transition? Protecting workers who’ll lose their jobs when the Eraring Power Station closes

The Centre for Future Work at The Australia Institute has urged the federal government to take charge of transitioning hundreds of workers into secure employment when the Eraring Power Station shuts down.